From cashless to super apps: Exploring fintech trends

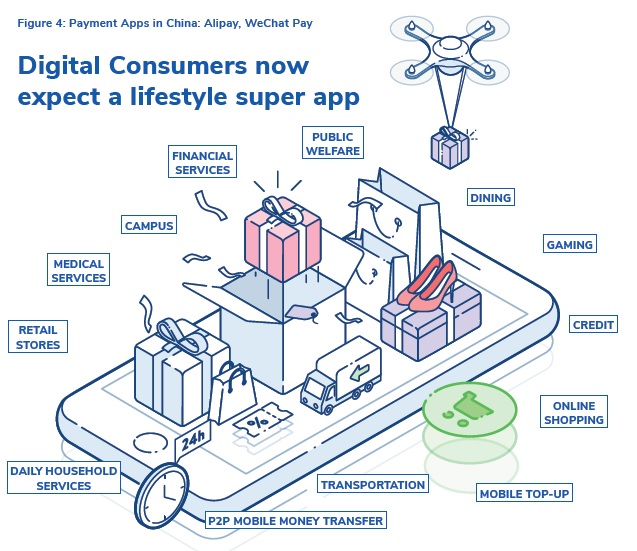

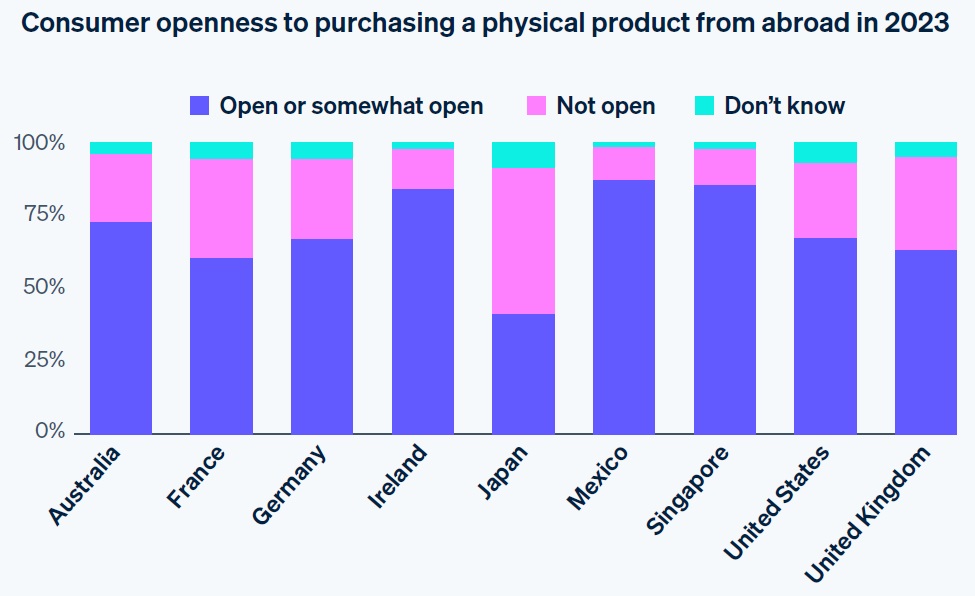

Fintech services continue to change, accelerate and improve the way we conduct our financial practices From cashless to super apps Technological innovations in fintech are continuing to evolve, as we reach the halfway point of 2023. Gen Z is leading the way for fintech service adoption as physical cash continues to diminish, whilst digital wallets, […]

From cashless to super apps: Exploring fintech trends Read More »